- PropMemo

- Posts

- Chicago Industrial Net Absorption Outpaces New Supply in 2024

Chicago Industrial Net Absorption Outpaces New Supply in 2024

The Chicago area saw 16.5mm SF of new supply in 2024 and 23.8mm SF of net absorption

Happy Friday!

Chicago industrial is back! Global REIT market size is expected to grow by $350bn over the next 4 years, and the “Golden Age” has begun (allegedly…)

If you enjoy the newsletter, then help us out by sharing with friends and colleagues. Click the referral link below to share the newsletter, hit milestones, get rewards!

Pay No Interest Until Nearly 2027 AND Earn 5% Cash Back

Use a 0% intro APR card to pay off debt.

Transfer your balance and avoid interest charges.

This top card offers 0% APR into 2027 + 5% cash back!

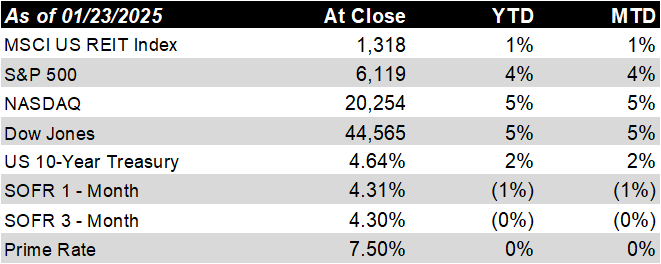

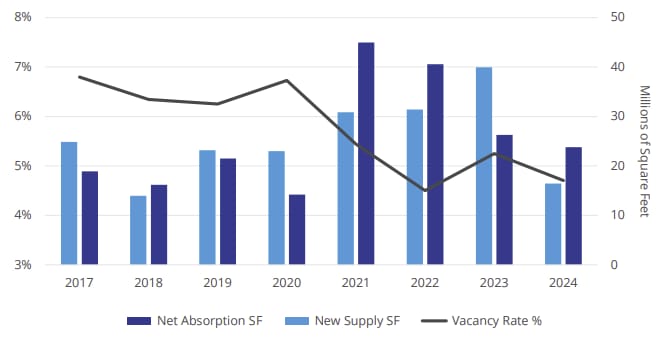

Capital Markets

Headlines

Chicago Industrial Net Absorption Outpaces New Supply

The Chicago area saw 16.5mm SF of new supply in 2024 and 23.8mm SF of net absorption. Construction deliveries were down from 40mm SF in 2023 and 31.4mm SF in 2022. After rising to 5.25% in 2023, the vacancy rate dropped to 4.70% in 2024, in line with 4.54% seen in 2022

Chicago Industrial Net Absorption

Source: Colliers

On Thursday Trump addressed business and political leaders at the World Economic Forum in Davos, Switzerland stating the US was “back and open for business”. He also talked about tapping into US oil and asking OPEC to bring down the price of oil, mentioning it would lead to the end of the Russia-Ukraine war

Global REIT Market Size Estimated To Grow by $350bn Between 2024-2028

According to Technavio, the global REIT market is estimated to grow at a CAGR of 2.87% from 2024 to 2028. Increase in global demand for warehousing and storage facilities is driving market growth, with a trend towards emergence of self-storage as a service

Deals Deals Deals

Sales

Multifamily: FPA Multifamily, LLC acquired two multifamily properties, totaling 674 units in Fitchburg, WI, from E.J. Plesko & Associates, Inc.

Industrial: Rosewood Property Co., and Pillar Commercial, acquired a two-building 201K SF industrial asset in Plano, TX from Provident Realty Advisors

Multifamily: Fairfield Residential acquired Chroma Park Apartments, a 365-unit multifamily property in Atlanta, GA, for $63mm from Federal Capital Partners

Office: Hudson Pacific Properties announces the sale of Maxwell, a 103K SF office asset in Los Angeles, CA, for $46mm

Multifamily: Habitat acquires a 214-unit townhome multifamily in Woodbury, MN from Boston Capital Group

Self Storage: Extra Space Storage Inc. acquired a 520-unit self storage facility in Denton, TX from NorthBridge Realty Holdings

Debt

Data Centers: A JV between Blue Owl Capital, Crusoe Energy Systems, and Primary Digital Infrastructure obtained a $2.3bn loan from JP Morgan to capitalize a 206 megawatt, 998K SF, two-building, build-to-suit data center development in Abilene, TX

Multifamily: Codina Partners refinanced the Palma Tower Complex, a two-building 481-unit multifamily community in Doral, FL, with a $124mm loan from HPS Investment Partners. Invesco exited ownership of Palma Tower One as part of the refinance

Multifamily: RISE Properties secures a $93mm mortgage for a 266-unit multifamily property in Seattle, WA from Mesa West Capital

Industrial: Upscale Developers secures $83mm in construction financing from BridgeCity Capital to build a condo development in Hudson Valley, NY

Multifamily: Murfey Company secures a three-year, floating-rate, $47mm loan from Buchanan Street Partners for a 149-unit multifamily property in San Diego, CA

Retail: DLC Management Corp. secured a five-year, fixed-rate $30mm loan from TriState Capital Bank for Taylor Square, a 378K SF Walmart-anchored center in Reynoldsburg, OH, and a five-year, $14mm note from Dollar Bank for Tuttle Crossing, a 227K SF Walmart shadow-anchored center in Dublin, OH. Island Capital and Casto sold the assets for a total of $76mm

Multifamily: Silverstone Properties secures a fixed-rate, five-year term, with one year of interest-only payments, and a 35-year amortization schedule, $25mm Freddie Mac Targeted Affordable Housing (TAH) loan for a affordable housing community in Levittown, PA (might have to start making a chart to describe these deals…)

Developments

Mixed-Use: TransMotaigne Partners is selling a ferry terminal site on Miami, FL’s Fisher Island for $180mm

Multifamily: Middleburg Communities begun the construction of a 290-unit multifamily community in Wilmington, NC. Eagle Realty Group provided the construction financing

Office: Childress Klein get approval to redevelop a 213K SF office campus in Charlotte, NC into a 675-unit multifamily community and 277K SF of office. A 77K SF office building will remain. The asset was acquired for $31mm in 2023

Capital Raising

Diversified: The National Pension Service of Korea is investing $800mm in real estate operating companies and in GP stakes with investment managers via a partnership with Almanac Realty Investors

Leasing

Seeking impartial news? Meet 1440.

Every day, 3.5 million readers turn to 1440 for their factual news. We sift through 100+ sources to bring you a complete summary of politics, global events, business, and culture, all in a brief 5-minute email. Enjoy an impartial news experience.

Meme Summary

Definitely the Golden Age for Trump Political memes

Wait till you see the taxes though…

Interested in advertising? Then get in touch with us